The worst retirement investing mistake

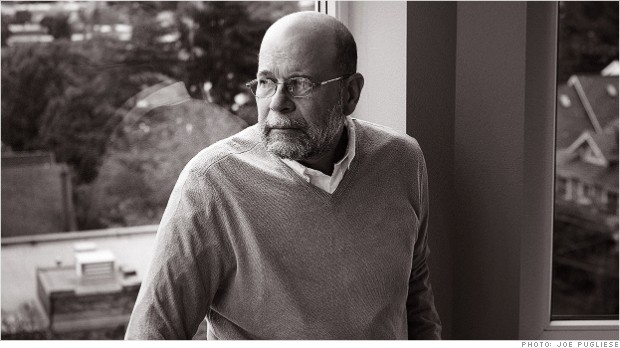

William Bernstein, investment adviser and author, says the worst mistake is not knowing when to take money off the table.

William Bernstein, investment adviser and author, says the worst mistake is not knowing when to take money off the table.NEW YORK (Money Magazine)

William Bernstein has a gift not only for grasping the complex but for helping the rest of us get it too.

He spent the first chunk of his career as a neurologist practicing on the coast of Oregon but cut back on his work hours in 1990. A few years later he focused on a new fascination: investing. He launched an online journal (a sort of proto-blog) called efficientfrontier.com and wrote "The Intelligent Asset Allocator," the first of several books. (He has also written for MONEY.)Now he's an investment adviser for a handful of high-net-worth clients. Bernstein's writing often explores academic financial theory, but he manages to turn it into practical, plain-English advice.

His latest obsession, resulting in the short e-book "The Ages of the Investor," is what economists call the life-cycle theory, which dictates that your asset allocation should be tied to your earnings power throughout your career.

Bernstein, 64, spoke with senior editor George Mannes; their conversation was edited.

There's a debate going on now among economists about how much exposure people should have to stocks. What made you weigh in?

It's almost like a political issue. There's a "right wing" of very smart, authoritative people who think that savers and retirees should be investing conservatively because stocks are so risky. And then there's a "left wing" of equally smart and authoritative people who believe the opposite.

I was trying to reconcile the two views. Plus, I wanted to deal with what happened in the 2008 financial crisis, which changed how people, myself included, think about risk.

How so?

A lot of people had won the game before the crisis happened: They had pretty much saved enough for retirement, and they were continuing to take risk by investing in equities.

Afterward, many of them sold either at or near the bottom and never bought back into it. And those people have irretrievably damaged themselves.

I began to understand this point 10 or 15 years ago, but now I'm convinced: When you've won the game, why keep playing it?

How risky stocks are to a given investor depends upon which part of the life cycle he or she is in. For a younger investor, stocks aren't as risky as they seem. For the middle-aged, they're pretty risky. And for a retired person, they can be nuclear-level toxic.

But at retirement you could be investing for several more decades. Don't you have time to make up for short-term losses?

At the end of your career, you have no more earnings capacity left beyond Social Security or a pension. You have less of what life-cycle theory calls "human capital."

So if you have a long series of bad returns, plus you're withdrawing 4% or 5% of your portfolio to live on it, then in 10 to 12 years, you may not have anything left. Withdrawals during the distribution phase combined with a bad bear market can completely destroy a retirement.

So how should I be investing near and after retirement?

You want to end up with a portfolio that matches your liabilities, meaning the amount you'll need to spend in retirement. The rule of thumb I came up with, based on annuity payouts and spending patterns late in life, is that you should save 20 to 25 times your residual living expenses -- that is, the yearly shortfall you have to make up after Social Security and any pension.

This portfolio should be in safe assets: Treasury Inflation-Protected Securities, annuities, or even short-term bonds.

Anything above that, you can invest in risky assets. That's your risk portfolio. If you dream about taking an around-the-world trip, and the risk portfolio does well, you can use it for that. If the risk portfolio doesn't do well, at least you're not pushing a shopping cart under an overpass.

What if you are nearing retirement age and you don't have that 20 to 25 years saved?

You should be working until you get that number. If you're 65 and you've only got half of your living expenses saved, you can retire and you may skate through.

Related: It's time to rethink retirement

You may die early, or you may have a good market. But there's a significant chance you're going to be eating Alpo when you're 85. That's the risk you're taking. The other choice you have is to work a few more years and reduce expenses.

One thing that we point out to our readers is that if you don't have stocks in your portfolio, you expose yourself to inflation risk.

That's true. By owning stocks you do mitigate inflation risk, but of course, you're exposing yourself to equity risk to do it. It's sort of like all these people who are now buying dividend-yielding stocks because Treasury bonds don't have any yield; they're exchanging a riskless asset for a risky asset.

But there's another asset class that people really don't think about when they think about inflation protection, which is short, high-quality bonds with a maturity of less than three years. If we ever do get an inflationary shock, investors will demand a high real short-term rate of return. It's what happened during the late '70s and early '80s.

Even though interest rates are terrible right now, if inflation recurs -- as I think it probably will -- short-term bonds are a fine place to be, as are individual Treasuries or certificates of deposit. Since they mature soon, you can replace them quickly with newer, higher-interest bonds.

Interest rates usually more than keep up with inflation. It's true that real yields right now are historically low, but as a student of financial history I have to believe that's not going to last forever.

Okay, so stocks are risky at retirement. What about when I'm young?

For the average person, you'll want a very high stock allocation. Let's imagine you start working at age 25, and let's say for the sake of argument you have 35 years worth of human capital -- that is, 35 years of salary left in you. That's an asset that you own. What you've saved in one year for retirement is still minuscule compared to that 34 years of earning and saving that you have left.

So even if your investment capital when you're 26 years old falls by one-half, your total worth has fallen by only a couple of percent because you still have that 34 years of human capital left. Your ability to earn and save dwarfs the loss in your portfolio.

And what about when I'm in the middle of my career?

That's the key phase. You need to start bailing out of risky assets as you get closer to achieving that liability-matching portfolio—when you can "win the game" without taking so much risk.

Related: What to tell the kids about your money

Instead of cutting your stock allocation one percentage point a year -- the standard formula -- in a year with absolutely spectacular returns, you might want to take 4% or 5% off the table. In a series of years when stock returns have been poor, you don't take anything off the table. And over time you start laying down a floor of safe assets with the proceeds from the stocks you've sold.

When exactly am I doing this?

Getting close to hitting your number is usually going to happen during a bull market, so the psychology of doing this right is tricky. It's hard to cut back on risk and accept lower returns when your neighbors are getting rich.

If you're very lucky and very frugal, hitting your number might happen when you're 45. In the worst-case scenario, you do everything right and still come up short at 65, so you wind up working longer or greatly paring back your expectations.

It sounds like retirement success depends on when you were born.

Yeah, that is certainly true. Young people should get down on their knees and pray for a brutal bear market at the beginning of their savings career, because that's going to enable them to buy a large number of shares cheaply. Having a sequence of bad returns first, followed by strong returns, is the best-case scenario.

I did a little thought experiment in which I calculated how many years it took people starting work in different years to make their number. I realized that the cohort that started working during the worst of economic times is the one that did the best.

REQUEST FOR our ebooks

on any topics on this blog or site

and get it deliverd to your email

PAY WITH

RECHARGE CARD

BANK

PAYPAL

AND GET THE COMPLETE MOVIL IN YOUR INBOX

OR FACEBOOK PROFILE

No Comment to " The worst retirement investing mistake "